Money answers for you

Wherever you are on your financial journey, we are here to help.

Explore Numerica's free checking accounts. Get answers to common questions, including how to open an account, check your balance, and manage deposits with ease.

A checking account is your home to cash checks, set up a direct deposit from your job, and pay bills. As a cornerstone to your financial well-being, it’s often the first account people open after breaking up with their piggy bank. (And you thought people who didn’t like piggy banks were afraid of change!)

Right now, you are probably afraid of more bad jokes. Let’s get to your checking account questions, which are mostly joke free.

If you would like a Numerica representative to assist you, open your account by calling 800.433.1837 or stopping by a Numerica branch.

Absolutely! Start your application now, and open a Numerica checking account from the convenience of your home.

A checking account is a convenient, secure way to access your money. At Numerica, we are all about helping you live well financially. We make it easy to use your checking account to keep your money organized and protected. Our accounts are federally insured by NCUA.

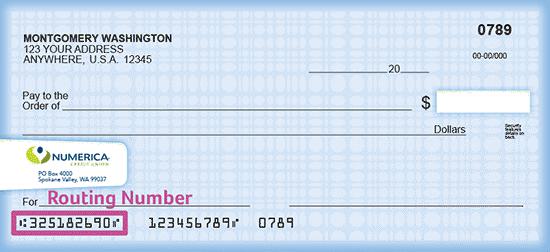

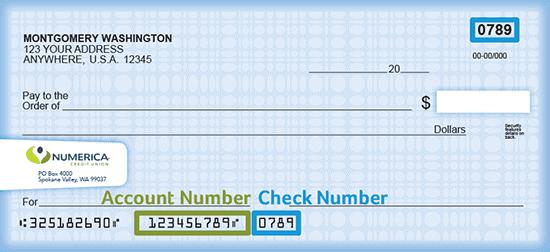

Your routing number is the first series of numbers on your check. This nine-digit code works like an ID number for your financial institution. Numerica’s routing number is 325182690.

The second series of numbers on your check is your account number.

The set of numbers right after that is your check number and should be the same as the number in the upper right-hand corner of the check.

Taken all together, the three numbers across the bottom of a check communicate the financial institution the check will be cleared by, the specific account the money will be taken from, and the check number used to identify the transaction.

First, log in to either Online Banking or the Mobile App. Choose “Accounts,” and then select the specific account you want to view. Your full account number will be listed near your available balance. It will be listed as your “ACH number.” If the number is concealed, tap the eye icon to reveal it.

See your account balance on our mobile app or in online banking.

We will help you order your initial checks when you set up your checking account setup process. Ready to reorder?

If your name or address has changed, this should be updated before ordering new checks. Call 800.433.1837 or stop by a Numerica branch to update your account information.

Numerica is committed to both the security and accessibility of your money. As we process deposits, we take care to follow all regulations and best practices.

When do these funds become available in your account? That depends on several factors, including:

Numerica’s Funds Availability Policy Disclosure is a great resource for reviewing timetables and scenarios. A copy is provided when you open an account, or you can request a copy anytime.

Of course, if you have a funds availability question specific to your account, we’re here to help. Reach out to us.

No. Your credit report only tracks your credit and debt.

Additionally, your checking account isn’t impacted by a low credit score. However, bad credit could impact your loan rates if you need a car, credit card, or if you decide to buy a home. It’s always a good idea to find ways to improve your credit.

Your ChexSystems record, on the other hand, could impact your checking account. ChexSystems identifies people who present a risk because of mishandling funds. If you’ve written a series of checks with non-sufficient funds (NSF), this isn’t reported on your credit score, but it could be reported to ChexSystems.

A poor ChexSystems report doesn’t necessarily mean you can’t open a Numerica account. At Numerica, our priority is your financial well-being. We offer a variety of options to help members build successful checking accounts — as well as establish or rebuild credit.

We get it. Life moves — sometimes a bit too quickly — and the funds you expect to be in your account may not be.

A checking account that goes negative triggers overdraft fees. While the best way to avoid overdraft fees is to limit your risk of insufficient funds, many financial institutions offer overdraft protection options. Call 800.433.1837 to discuss options for Numerica accounts.

Numerica has two different free checking accounts: Free Checking and Bonus Checking. With Bonus Checking, there is no minimum balance or monthly fees after opening your account. Both accounts let you customize your debit card with either a Numerica motif or designs celebrating local colleges, including Gonzaga, EWU, and Whitworth.

On the surface, this may seem like an easy solution, but it’s a definite no-no. Using your personal account for your business transactions can affect your legal liability.

As soon as you register your new business, you should open an account specifically for it — even if it’s a home business or side-hustle.

Since businesses come in all shapes and sizes, Numerica has a diverse line of products to serve them, including several business checking account options. We can match your business needs to the right products. Visit a nearby branch to open your account today.

When you opened your checking account, you should have received a debit card either in the mail or at the branch.

If you have misplaced your debit card, you can activate Card Freeze until you can find it or replace it with a new card. Using the Mobile App, you can freeze or unfreeze your card in seconds at any time.

If you believe your card is lost or stolen, please contact us immediately at 800.433.1837 so we can permanently block the card and send you a new card with a new number.

Representative: Would you like a savings account, too?

Person: No, thank you.

Representative: OK, just checking.

What accounts are best for you? Let’s talk! Call 800.433.1837 or stop by your favorite Numerica branch today.